multistate tax commission form

Gross receipts from a construction project are attributable to Idaho if the construction is. QA on Completing Form CBT-DIV 2017 NJ.

Businessusetaxexemptform Motion Raceworks

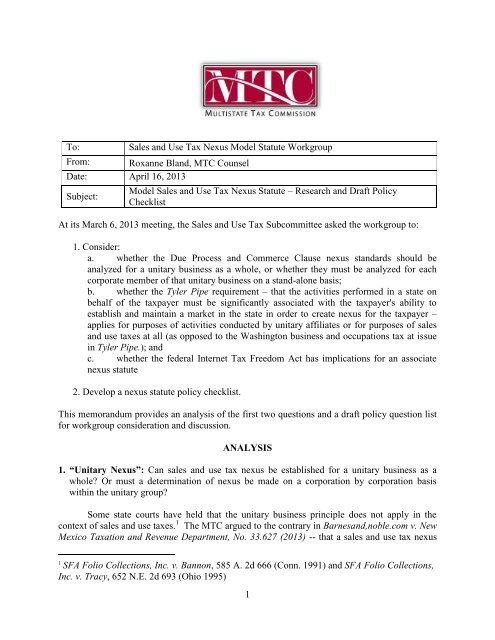

The Multistate Tax Commission has filed an amicus brief with the Oregon Tax Court in Santa Fe Natural Tobacco Co.

.jpg.aspx?lang=en-US?width=250&height=306)

. 86-272 with respect to internet activities. This tutorial video goes over how-to configure accepted states on the Multistate Tax Commission MTC form in EXEMPTAX. The New Jersey Division of Taxation Division has issued notices in light of recent state tax reforms A4202.

How-to Use Multistate Tax Commission MTC Forms. Definition of Member States Compact members are states represented by the heads of the tax agencies administering corporate income and sales and use taxes that have enacted the Multistate Tax Compact into their state law These states govern the Commission and participate in a wide range of projects and programs. If playback doesnt begin shortly try restarting your device.

Form 402 Instructions Individual Apportionment for Multistate Businesses completed at the end of the tax year. It is the executive agency charged with administering the Multistate Tax Compact. Sales Factor The sales factor is double weighted for all taxpayers except electrical and telephone utilities.

Not all states allow all exemptions listed on this form. See previously issued Multistate Tax Alert for more details on these 2018 law changes that explains what business entities are included. New Jersey DOT Issues New Supplemental Form on Reporting IRC Sec.

Created by the Multistate Tax Compact the Commission is charged by this law with. The Multistate Tax Commission is an intergovernmental state tax agency working on behalf of states and taxpayers to facilitate the equitable and efficient administration of state tax laws that apply to multistate and multinational enterprises. However the selling dealer must also obtain a resale authorization number from the.

Many companies use it even for documenting exemptions in only one state mostly because it is so widely available. Enter the credit for income tax paid to other states from Form 39R or Form 39NR. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale.

86-272 income tax immunity. The New Jersey Division of Taxation Division has issued a bulletin in light of recent state tax reforms A4202. Streamlined Sales Tax System Certificate of Exemption.

The Multistate Tax Commission MTC is updating its Public Law 86-272 guidance Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States under Public Law. See previously issued Multistate Tax Alert for more details on these 2018 law changes that collectively mandate combined reporting for. Capitol Street NW Suite 425 Washington DC 20001-1538 Re.

This credit is available only to individuals trusts and estates. The Multistate Tax Commissions model general allocation and apportionment regulation contemplates a similar scenario providing that where a taxpayer has two independent unitary businesses a separate apportionment formula should be applied to the income arising from each business. 4 2021 the Multistate Tax Commission MTC approved the fourth revision to its Statement of Information Concerning Practices of the Multistate Tax Commission and Supporting States Under Public Law 86-272 the Statement which added a section on activities conducted over the internet.

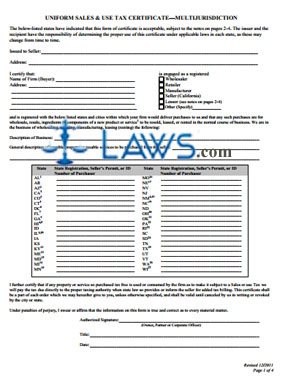

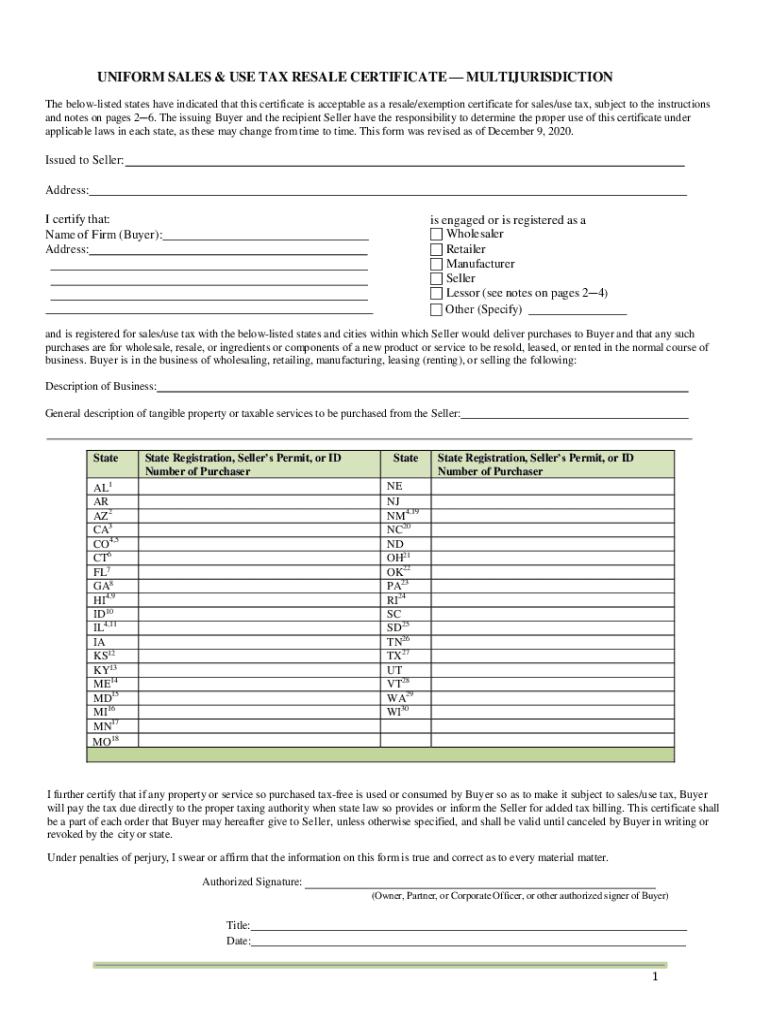

This case considers whether in-state activities conducted by an independent contractor pursuant to a contract with an out-of-state seller negates the sellers PL. Allows the Multistate Tax Commissions Uniform Sales and Use Tax Resale Certificate Multijurisdiction for tax-exempt purchases for resale. The instructions on the form indicate the limitations Ohio and other states that accept this certificate place on its use.

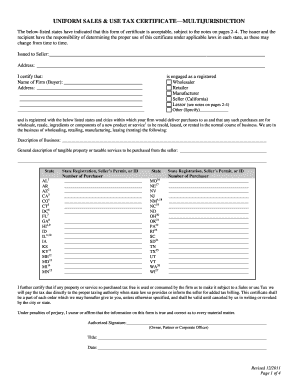

The Multistate Tax Commission has created a Uniform Sales and Use Tax Exemption Certificate to meet this need and the MTC multistate tax. See previously issued Multistate Tax Alert for more details on these 2018 law changes. The seller may be required to provide this exemption.

See previously issued Multistate Tax Alert for more details on these 2018 law changes. Streamlined Sales and Use Tax Agreement Certificate of Exemption. Electrical and telephone utilities use a single-weighted sales factor.

Multistate Tax Commission Multijurisdiction Resale Certificates. Guidance for the Reporting of IRC 965 Income and Other Corporation Business Tax Changes Retroactive to Tax Year 2017 NJ. Along with many other states California adopted the MTC certificate.

Multistate Tax Commission June 13 2018 Page 1 of 10 June 13 2018 Ms. Sovereignty members are states that. 86-272 Statement which provides guidance on how the MTC and adopting states interpret and apply PL.

Ohio accepts the Exemption Certificate adopted by the Streamlined Sales Tax System. Similarly the Uniform Division of Income for Tax Purposes Act allocates. Commission members acting together attempt to promote uniformity in state tax laws.

This is the computed tax before adding the permanent building fund tax or any other taxes or subtracting any credits. The MTC MJ is the standard form to which most people refer when discussing the MultiJurisdiction form also sometimes called the MTC MJ Multi-J or just Multi. The Multistate Tax Commission MTC National Nexus Program is now offering a special limited-time voluntary disclosure initiative that will run from August 17 2017 through October 17 2017 and generally will be made available to online sellers that have nexus with a participating state as a result of having inventory located in a fulfillment.

Multistate Tax Commission MTC Draft Model Sales and Use Tax Notice and Reporting Statute Dated April 25 2018 Dear Ms. Form 402 Instructions Individual Apportionment for Multistate Businesses paid by subtenants. 965 Income for CBT Purposes.

This form may be obtained on the Multistate Tax Commissions website. On August 4 2021 the Multistate Tax Commission MTC adopted revisions to its Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States Under Public Law 86-272 PL. This is a multi-state form.

The Multistate Tax Commission MTC issued the multijurisdiction resale certificate MTC certificate in July 2000 to provide a standard document for businesses to utilize that will be uniformly accepted by sellers. Seeking to clarify the matter on Aug. Enter the smallest amount from lines 5 6 or 7.

SMART TAX USA - The Multistate Tax Commission MTC As the Internet continues to grow and interstate commerce increases the need for a printable multistate tax form that taxpayers can download online also continues to increase. As of 2021 the District of Columbia and all 50 states except for Nevada are members in some capacity. Videos you watch may be added to the TVs watch history and influence TV recommendations.

For example if the project was 30 complete at the end of the tax year 30 of the bid price should be included in the gross receipts. The Multistate Tax Commission is an interstate instrumentality located in the United States. Subrents arent deducted if theyre business income.

Loretta King Multistate Tax Commission 444 N.

Uniformity Committee Memo Multistate Tax Commission

Free Form Uniform Sales And Use Certificate Free Legal Forms Laws Com

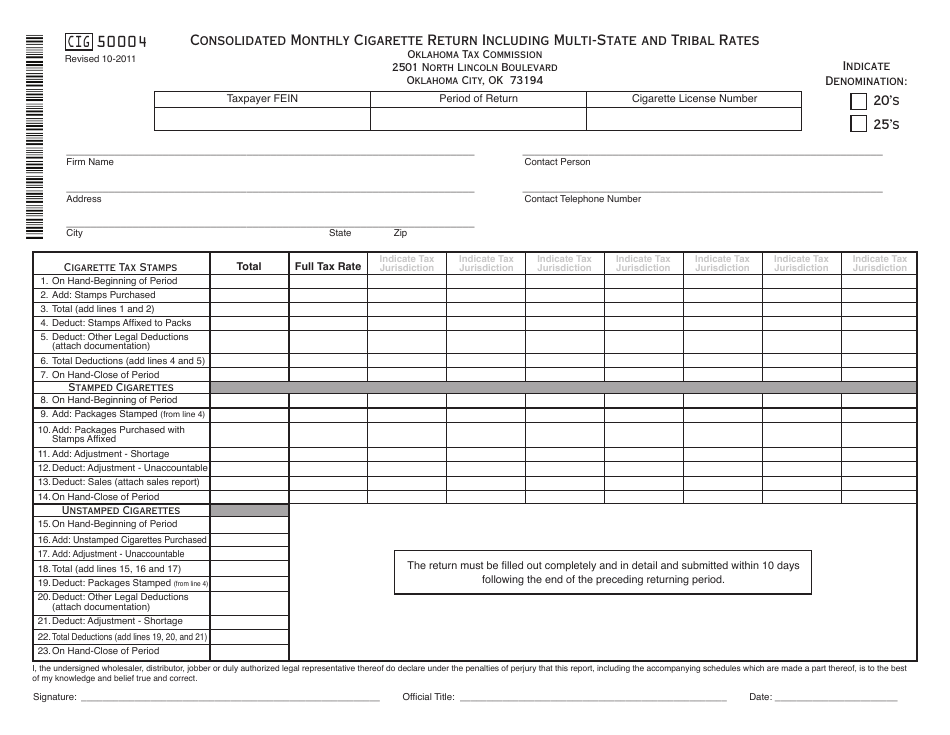

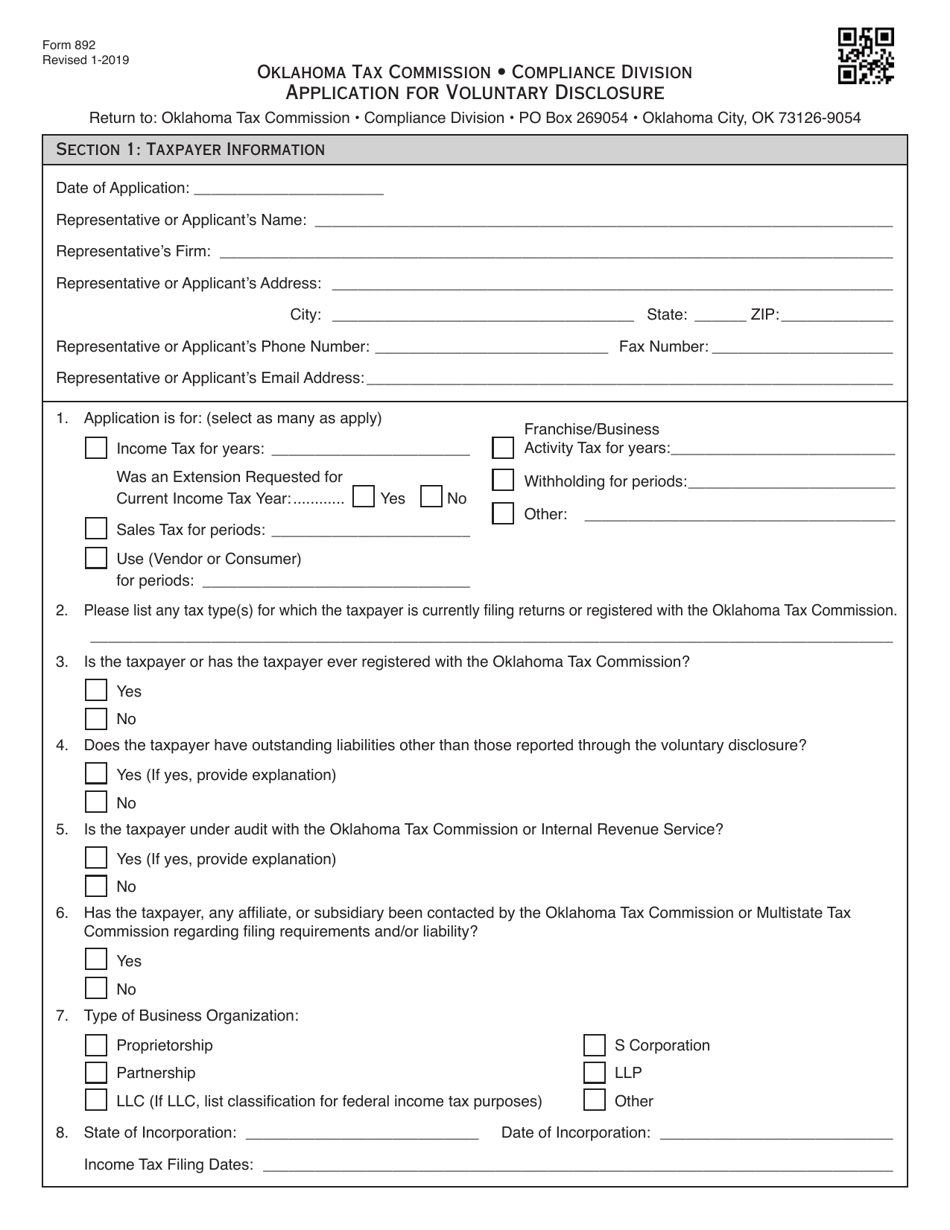

Otc Form Cig50004 Download Fillable Pdf Or Fill Online Consolidated Monthly Cigarette Return Including Multi State And Tribal Rates 2011 Oklahoma Templateroller

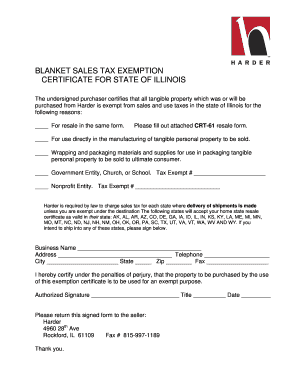

Multi State Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

2011 Mtc Uniform Sales Use Tax Certificate Multijurisdiction Fill Online Printable Fillable Blank Pdffiller

Materials Multistate Tax Commission

Otc Form 892 Download Fillable Pdf Or Fill Online Application For Voluntary Disclosure Oklahoma Templateroller

Multistate Tax Commission Home

.jpg.aspx?lang=en-US?width=250&height=306)

Multistate Tax Commission News

Mtc Mission Values Vision Goals Multistate Tax Commission

Understanding Sales Tax With Printify Printify

2020 2022 Mtc Uniform Sales Use Tax Certificate Multijurisdiction Fill Online Printable Fillable Blank Pdffiller

Gl 22051 Nd Gov Tax Indincome Forms 2008

Multistate Tax Commission News

State Sales Tax And Corporate Income And Franchise Tax After Wayfair Wagner Tax Law

Multistate Tax Commission Audit Program

Special Rules Television And Radio Broadcasting Multistate Tax

Uniform Sales And Use Tax Exemption Certificates Accuratetax Com